Open Letter: A call for clear rules and incentives in the EU’s Green Claims Directive

The carbon removal sector proposes that the Green Claims Directive should recognise the role of climate claims for incentivising investment in permanent and high-integrity carbon removals, as long as this neither impedes nor reduces a company’s absolute emissions reduction target.

Reducing greenhouse gas (GHG) emissions remains the most immediate and effective way of slowing climate change and should be the primary focus of the EU’s climate activity. However, rapid decarbonisation of our economy is sadly, no longer sufficient .Each of the 230 scenarios the IPCC has modelled to limit global warming to below 1.5°Cincludes carbon dioxide removals (CDR) at scale, ranging from 6-10 Gt of CO2 removed per year by 2050.

The IPCC report clearly states that: “The deployment of carbon dioxide removals to counterbalance hard-to-abate residual emissions is unavoidable if net-zero carbon dioxide or GHG emissions are to be achieved” so in order to achieve the EU’s ambitious net-zero targets, near-term investments in high-quality, permanent carbon removals needs to be incentivised.

Given the current regulatory framework, the only source of income for carbon removal relies on state subsidies and voluntary carbon markets. Policymakers should seek to prohibit greenwashing while facilitating near-term purchases of high-integrity carbon removal.

Corporate environmental claims play a critical role in carbon removals purchasing and investment decisions, and appropriate rules regarding company-level claims must be put in place to incentivise investment into high-integrity, permanent carbon dioxide removals (CDR).

Companies should be incentivised to purchase high-integrity carbon removals, provided these claims are transparent and neither impede nor reduce absolute emissions reduction efforts and targets. Allowing companies to make compensation claims with regard to these purchases is critical, since companies’ climate ambition is often measured by their efforts to achieve their net-zero targets. This will encourage investment in the nascent carbon removals market and support the EU’s negative emissions target.

Whilst we support the aim of recent EU pieces of legislation to avoid greenwashing and increase transparency around climate-related claims, we are concerned by the lack of clarity of the current legislative process.

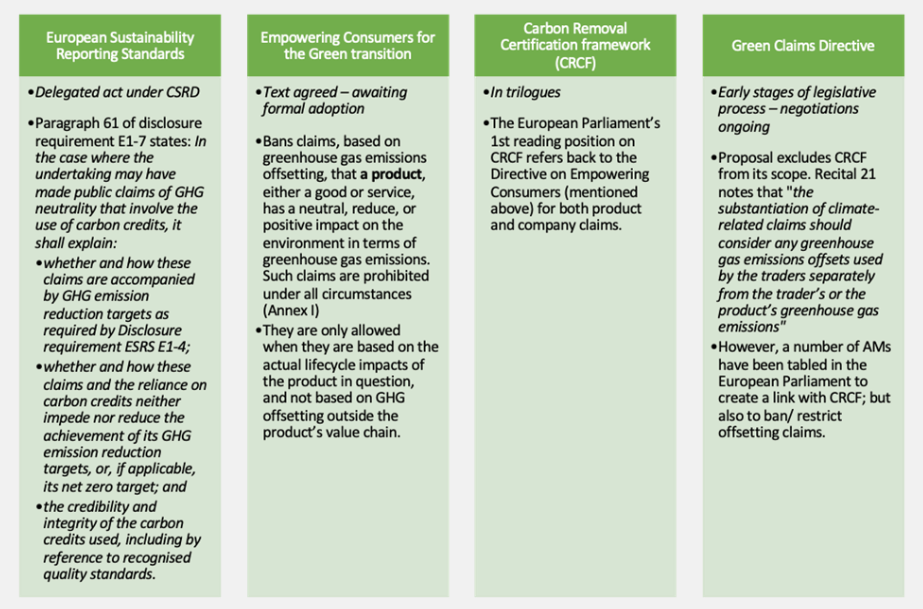

Several pieces of EU legislation currently cover claims based on carbon credits:

The rules under development today do not universally encourage near-term purchases of CDR, nor investment in this sector. It is therefore important that rules around climate claims are designed to support CDR development at scale. This uncertainty is hindering ambitious EU policy objectives and the European Commission’s goal to accelerate the deployment of negative emissions. As a result, this could impede the EU’s progress toward achieving its climate objectives in the upcoming decades.

The role of each of these pieces of legislation for regulating climate claims based on carbon credits must be clarified, and any overlapping provisions harmonised to reduce the administrative burden on companies complying with these provisions.

We therefore propose that the Green Claims Directive should recognise the role of climate claims for incentivising investment in permanent and high-integrity carbon removals, as long as this neither impedes nor reduces a company’s absolute emissions reduction target.

Therefore, we urge policymakers to:

Allow company-level climate claims based on high-quality removals for residual emissions, defined as unabated emissions when the yearly potential for economically reasonable reduction measures in the value chain has been exhausted, ensuring that compensation measures neither impede nor reduce the achievement of GHG emission reduction targets. Companies would be required to transparently report where they had used permanent removals credits and describe how the removals don’t lessen emission reduction efforts.

By allowing green claims based on permanent removals for these residual emissions (year-by-year applying economically reasonable measures to achieve reductions throughout the value-chain), this increases ambition as it incentivises companies to take additional responsibility for their gross emissions immediately, rather than applying ineffective traditional off-set instrument.

This aligns with the provisions set out in the European Sustainability Reporting Standards (ESRS) which requires companies to explain any green claims of GHG neutrality that involve carbon offsets, evidence the integrity of offsets used and prove that this does not impede the achievement of GHG emission reduction targets. Companies should explain whether and how these claims are accompanied by emission reduction targets.

Ensure that removals credits are based on high-quality removals of carbon from the atmosphere/biosphere with an increasing emphasis on permanent removals over time, whilst respecting the like-for-like principle.

Assess how carbon removal credits from outside EU will be treated on the EU market given that the scope of the CRCF will be limited to carbon removals within the EU.

Signatories